Excess Inventory – mitigate the impact and move forwards

Most brands and retailers will have dealt with overstock inventory before – but today businesses across the globe are warning of “excessive inventory” that is already beginning to dampen the considerable surge in profits seen by many. At worst, dead stock will need to be disposed of at an additional cost. At best, excess inventory is likely to cause issues for at least the next few quarters.

Overstock inventory are perfectly good products that haven’t sold within a realistic timeframe. Instead of bringing in revenue, they take up valuable space and eat into profit. It’s a common issue in eCommerce. Even big brands struggle with excess inventory (the inventory balance of Nike shot up this quarter to $7.7 billion, from $6.5 billion at the end of November 2021).

However, despite the current difficulties, Upp’s connected retail performance platform is helping clients across multiple industries to achieve a 27% increase in growth of revenue.

We’ve detailed below eight ways in which online brands can mitigate the problem – but why is it so widespread?

Unprecendented times…

The problem began with COVID, back in March 2020 causing global supply chain issues. Then Russia’s invasion of Ukraine and the subsequent scarcity of fuel and raw materials drove up the cost of doing business. Due to these unprecedented times, the world is now facing a cost-of-living crisis, with high inflation making it more difficult for the consumer to spend.

With the spread of the coronavirus came “lockdowns” and consequently purchasing behaviour changed on an extraordinary scale. Demand for “essential supplies” went through the roof, and the velocity of digital commerce sales skyrocketed, with many new brands coming onto the market to fulfil higher demands due to lockdown.

Nobody could foresee the future, lockdowns became global, and nobody could gauge how long this would continue. Many producers of non-essential goods paused production to avoid holding inventory they knew they couldn’t sell.

China’s foreign trade saw massive slumps in foreign demand, and this is when supply chain disruption on the supply side began.

Global Supply Chain Issues

It is at this point that issues with inventory began: the highly optimized global supply chain was broken by this pause in ordering. Eventually, we began to understand that COVID was not going to cause such inertia forever, but this was not the beginning of a return to normal. Spending habits had changed, and everyone was staying in (and buying for) their home.

Therefore, consumer businesses began re-ordering in large volumes – to account for new demand and make up for missed production. Factories became inundated with orders.

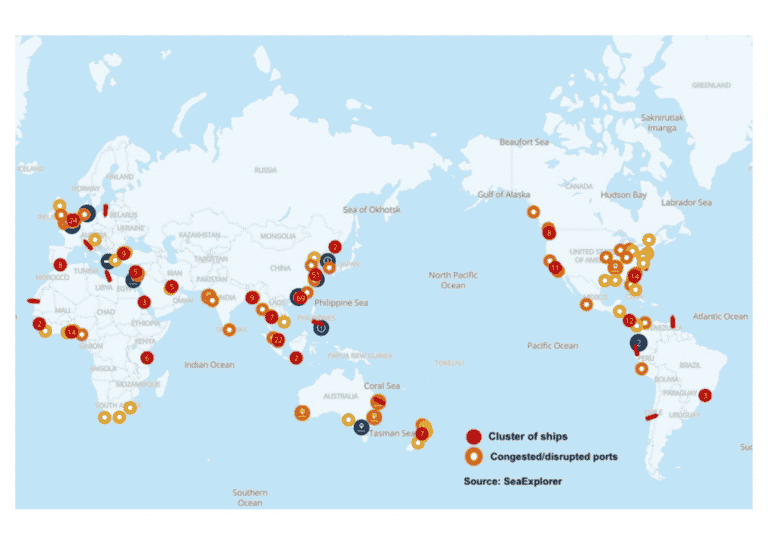

This massive increase in demand for consumer durable goods from East Asia put the global shipping system under stress. And the sustained surge in demand for shipping containers from East-Asia (combined with no slack capacity in container ships) pushed up shipping rates to record highs. Operational disruptions, including pandemic-related shutdowns of major ports, put global logistic systems under further stress and increased trade costs uncertainty.

In this environment, importers and exporters from many developing countries faced huge challenges in shipping their products. With such a strain on the system, bottlenecks inevitably occurred and global liner reliability fell from above 70% pre-pandemic, to below 40% in 2021.

Inventory management

A large part of inventory management relies on the reliability of production and shipping times, but with demand high many retailers felt they had little choice but to buy more inventory – to compensate for the uncertainty with shipments and cope with demand. Using Upp’s platform, inventory management can be more aware of true demand and which products are selling, which will help decision-making moving forward.

Todays Market

Essential goods and parts remain unshipped from Russia and Ukraine and are not arriving as scheduled globally. And high inflation and the escalating cost-of-living crisis are making it harder for the consumer to spend – leaving retailers searching for solutions for their overstock.

Dealing with Excess Inventory

Putting everything on sale not only reduces revenue it also risks weakening your brand. Consider the following:

- Some overstock may be the result of poor Google Shopping performance – we know as much as 80% of SKUs get ZERO visibility so our platform can make these products more visible to help alleviate the problem

- Protect and prioritize bestsellers and long-term SKUs. Use your data and reserve promotional strategies for things that are seasonal or climate sensitive. Treat these discounted products as gateways for full-price purchases on non-seasonal items. Upp works with you to automatically promote the SKU’s you price to sell, whilst protecting profit on your bestsellers.

- Conduct a price reset. Review your inventory’s pricing and adjust whatever doesn’t make sense. Preserve GMROI wherever possible, but remember you have a whole assortment of inventory. Some will sell better than others, increasing your margin – allowing you to make sacrifices elsewhere.

- Opt for bulk discounts over markdowns. This delivers higher cart values whilst preserving product integrity and optimizing logistics costs.

- Bundle sets of complementary products. Thereby moving inventory without visibly reducing retail prices.

- Use Inventory to highlight social responsibility awareness. Charitably donating excess inventory builds trust in your brand – friendly re-use and disposal comes with immense value.

- Assess your marketing. There may be higher demand elsewhere – are there channels or regions you haven’t entered, or alternative uses for your products? Upp connects Google audience data with your product performance data to better understand true demand and automatically maximises product visibility to capture this demand. Meaning you can focus your achieving your revenue potential in other channels whilst Upp continuously drives your Google Shopping performance.

- Enrich your inventory dataset with Upp – through SKU level reporting, you will know exactly how much each SKU is receiving in Ad Spend v Actual Revenue generated to better inform inventory management activities and decisions

Moving forwards, brands and retailers must ensure they continue their digital commerce growth (investing in capabilities to ensure this, is regarded as vital for 90% of business leaders recently surveyed by Gartner). Upp’s connected retail performance platform is unlocking opportunities to maximize revenue potential within the current market conditions.

A recent survey of our clients across multiple businesses and regions has shown:

- 48% increase in available ad budget spent

- 16% increase in new customer purchases

- 14% increase in conversion value for brands

We are helping customers to use their inventory performance AND non-performance to drive future revenue, using ad spend more beneficially than has been previously possible. A recent audit of our customers revealed, on average, a 62% increase in the rate of transactions – a significant figure when the volume of transactions retailers are seeing is slowing down.

We optimize revenue opportunities, whilst protecting profit. And Upp is the only platform that does this, by intelligently analyzing both your business data and Google Shopping performance data to drive the actions your business needs for success in this climate. See for yourself how Upp can help – we can offer you a free data-led review and make recommendations to help you navigate not just the current environment but the changes your business will encounter in the future.