Black Friday Secrets Revealed

Blog series #1 – Do I feel like spending?

We’re gearing up for the Golden Quarter with a four-part series covering everything retailers need to know during this peak period. Kicking things off with a look at the broader macroeconomic environment and how it shapes consumer confidence, ultimately influencing spending patterns during this critical time.

This mixed picture makes predicting the outcome for retailers extremely difficult, but we’re here to help make sense of the chaos.

Confidence is up

The pressures of the cost of living crisis appear to be easing; inflation has fallen, interest rates have been cut (with additional rate cuts expected before the end of the year), and wages, benefits and pensions have risen. This is all reflected in consumer sentiment which, according to the PwC Consumer Sentiment Survey conducted in July 2024, rose to its highest level since September 2021.

Great news for consumer businesses as the index has been a reliable early indicator of future consumer spending patterns over the following 6 to 12 months.

BUT – Consumers remain cautious

Is this trend likely to continue? It looks like inflation improvements have levelled off, staying close to the Bank of England’s 2% target. However, services inflation remains persistently high. Plus, we’ve got rising energy prices coming up—thanks to the energy price cap increase in October—and grocery prices are expected to go up this autumn too. On top of that, about half a million households will need to renew their mortgages later in 2024, and they’ll be facing higher interest rates.

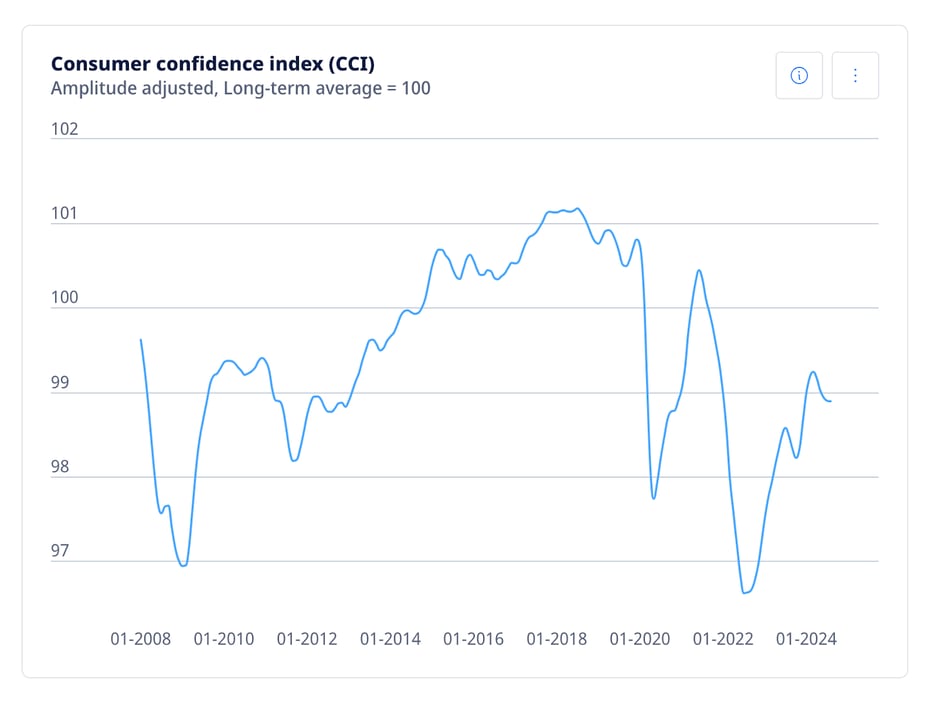

Finally, negative publicity surrounding the state of the UK’s finances appears to have damaged confidence in the economic outlook with the OECD Consumer Confidence Index tailing off slightly in August.

Source: OECD, August 2024

The impact on Black Friday 2024

Total sales during Black Friday 2023 in the UK reached an estimated £13.3 billion, up 7.3% year-on-year. So can we expect growth this year as well?

The Power of Promotions

According to Mintel (UK Black Friday market report 2024), 52% of Black Friday shoppers say financial concerns meant they relied on promotions more than usual.

The importance of in-store

While Black Friday remains an online-first retail event, in-store Black Friday purchasing has grown since 2021 and represented 45% of spending in 2023. Retailers and brands have an opportunity to gain a further share of Black Friday demand by leveraging the USP of physical space to create an ‘event’ feeling of coming into a store during the promotions.

Spending over Black Friday weekend by channel

Source: Statista, 2024

Timing of campaigns

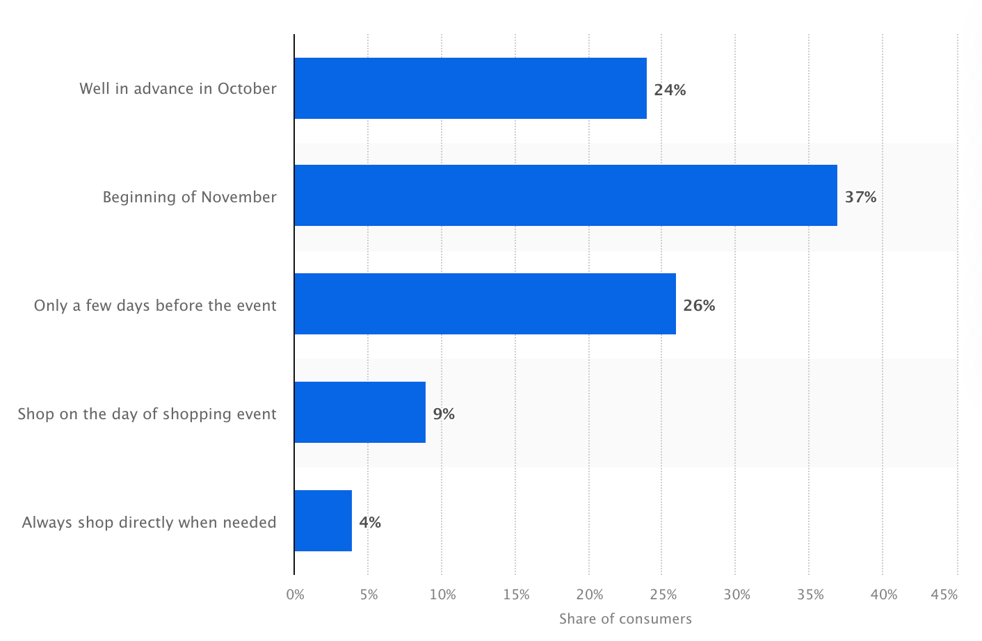

Consumers start searching for promotions early, in fact 61% begin in October and early November which means retailers and brands must have their promotions in place well in advance of October in order to attract the organised shopper. The timing of payday is a factor as well, coinciding exactly with Black Friday, which is likey to boost sales this year.

Another significant consideration is the timing and duration of Amazon Prime Big Deal Days which occur on 8th and 9th October this year and will drive considerable spending; estimated at nearly $13bn globally in 2023.

Purchases over the Black Friday and Christmas periods are in the majority (84%) Christmas gifts and gifts for loved ones indicating that the peak buying period starts on Black Friday but extends right through Christmas and into New Year sales.

UK consumers search for deals well in advance of Black Friday

Source: Statista, 2024

What are the likely outcomes?

We are certainly looking at a more rosy picture this year. Consumer confidence is at a three-year high, household finances are in the best shape they have been for two years, and there is pent-up demand for luxury goods. The socio-economic groups that have traditionally enthusiastically bought into Black Friday are joined by the better off to boost the spending potential this year.

Competition for those consumers spending will be high, both online and offline, and a well-constructed campaign beginning in advance of Black Friday and extending, potentially, into January 2025 is going to be a necessary consideration.

Find out how Upp.ai’s automation for online product advertising, can give you the competitive edge.

Book a call with one of our experts to find out more.